Hungary is a small and open economy depending on foreign capital and exports. As far as geographical distribution, structure and the size of exporting companies are concerned, Hungarian export is concentrated. The share of the European Union in Hungary’s exports (imports) was 76% (70%) in 2012. Asian countries certainly do not have a big share in Hungarian foreign trade but their role is increasing. The role of the Asian region is more significant in Hungarian imports (13.7% in 2012) than in exports (6.4%).

Hungary’s trade with different Asian regions

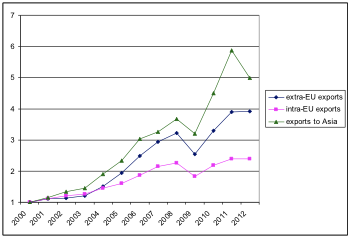

Between 2000 and 2012 Hungarian exports to Asia increased fivefold, and imports from Asia increased only twofold in value. Exports to Asia increased more dynamically than exports to other regions during the years since 2000. This trend is more remarkable between 2009-2011. However, in 2012 the export dynamism is broken again to all areas but mostly towards Asia

Figure 1 Increase of Hungarian exports to certain regions (2000=1)

Source: Eurostat

Regarding Hungarian imports from Asia, until 2004 these increased more dynamically than imports from other regions and since then it has increased in a similar way than imports from the EU. For 2011 and 2012 imports from Asia decreased, meanwhile imports from the EU increased.

In order to analyse regional distrubution of trade we formed 5 country groups:

- Commonwealth of Independent States (CIS): Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan,

- West Asia: Bahrain, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, Syria, United Arab Emirates, Yemen,

- South Asia: Afghanistan, Bangladesh, Bhutan, India, Iran, Maldives, Nepal, Pakistan, Sri Lanka,

- Southeast Asia: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar (Burma), Philippines, Singapore, Thailand, Timor-Leste, Vietnam,

- Northeast Asia: Hong Kong, China, Japan, North Korea, South Korea, Macao, Mongolia, Taiwan.

Hungary’s Asian exports are directed mainly to Northeast and West Asia and the majority of imports come from Northeast Asia, mainly from China. Hungarian trade with Asia shows considerable deficits throughout the period. However, this deficit is caused mainly by the highly uneven trade with Northeast Asia. Here approximately 70% of the deficit comes from the trade with China.

Table 1 Shares of Asian regions in Hungarian trade

|

|

West Asia |

South Asia |

CIS |

Southeast Asia |

Northeast Asia |

|||||

|

|

Exp |

Imp |

Exp |

Imp |

Exp |

Imp |

Exp |

Imp |

Exp |

Imp |

|

2000 |

17.20 |

1.41 |

7.21 |

1.85 |

4.74 |

0.46 |

32.86 |

26.46 |

37.99 |

69.83 |

|

2007 |

35.09 |

1.50 |

6.48 |

1.98 |

9.25 |

3.09 |

7.51 |

11.71 |

41.67 |

81.71 |

|

2012 |

31.23 |

1.53 |

5.51 |

3.08 |

5.70 |

0.72 |

12.09 |

11.90 |

45.47 |

82.77 |

Source: Own calculations from Eurostat data

Around 80% of Hungary’s Asian imports come from Northeast Asia and around 45% of exports is directed there (see Table 1). By the end of the observed period China has become the most important country of the region by far. However, this has not always been the case, since Japan held the leading position in imports until 2002 and in exports until 2004. During the following years the share of Japan declined radically and continuously, until it reached a figure below 20%.

The second most important Asian region for Hungarian exports is West Asia. In Hungarian imports, however, the share of this region is negligible, around 1%. The main partner here is the United Arab Emirates, although with considerable fluctuations. In 2012, 57.6% of Hungarian exports to West Asia were directed to the UAE. The second most important market in the region for Hungarian products is Israel, and the third one is Saudi Arabia.

The third most important Asian region for Hungarian exports is Southeast Asia. Singapore is the main export market in Southeast Asia, followed from afar by Malaysia and Thailand. Regarding South Asia, India is the dominant export market while among the CIS countries Kazakhstan and Uzbekistan are the most important ones.

Product structure and concentration

In the structure of Hungarian exports to the five Asian regions a considerable change took place during the examined period. In 2000 chemicals and related products occupied a significant share in the export to almost all Asian regions, but for 2012 this share shrank to a small share (4-7%) (except for the CIS countries where their share increased). In the meantime the weight of machinery and transport equipment has become generally overwhelming.

The calculations of Finger-Kreinin similarity indices for bilateral exports and imports in 2000 and 2012 also justify racidal changes in the product structure of trade. The calculation of similarity indices for Hungarian exports for three sub-periods showed that in almost all cases main structural changes happened before the crisis, until 2007.

Beside the changes in product structure, concentration is another important phenomenon. According to the calculation of Herfinfahl-Hirschman indices the concentration is high in Hungarian trade with Asia, even in those relations where relatively lot of products are traded (e.g. China, Hong Kong, Singapore). The general concentration level of Hungarian exports to Asia is much higher than the concentration in exports to the EU or in exports to all extra-EU territories. Telecommunication equipments and parts play a crucial role in Hungarian exports to Asia, in most cases these are the first or second export products. Deep analyses of traded products prove the high role of multinational companies in trade. In general, the fragmentation of production increased in the world during the past decade and this is manifested in the Hungarian trade with Asia too.

Table 2 Types of firms trading with Asia

|

|

Foreign multinationals |

Hungarian large firms (multinationals) |

Hungarian SMEs |

|

Entering Asian market |

easy |

relatively easy, based on former contacts |

difficult |

|

Motives |

assembly, intrafirm trade |

gaining new markets |

gaining new markets |

|

Volume of trade |

large |

large, medium |

small |

|

Effect of the crisis |

changing locations |

not significant, depends on product characteristics |

can be strong, negative |

Apart from the foreign multinational companies that have an essential role in the Hungarian-Asian trade there are other players: Hungarian large companies and small and medium-sized Hungarian firms. The way and the degree to which they participate in this trade is different (see table 2)

The characteristics of the product can be very important. There are successful innovative companies in the high-tech segment, like precision, medical instruments or membranes for water treatment. Often there are initiatives from the Asian countries coming to Hungary and looking for providers. Financing requirements of the operations on the Asian markets are rather high. This is the field where the recent international economic crisis had negative effects even on those SMEs that have successfully found their market niches.

Andrea Éltető, Katalin Völgyi

This blogpost is based on the working paper prepared in the framework of the project ’Trade with Asia’ No. 11220101 financed by the International Visegrad Fund.